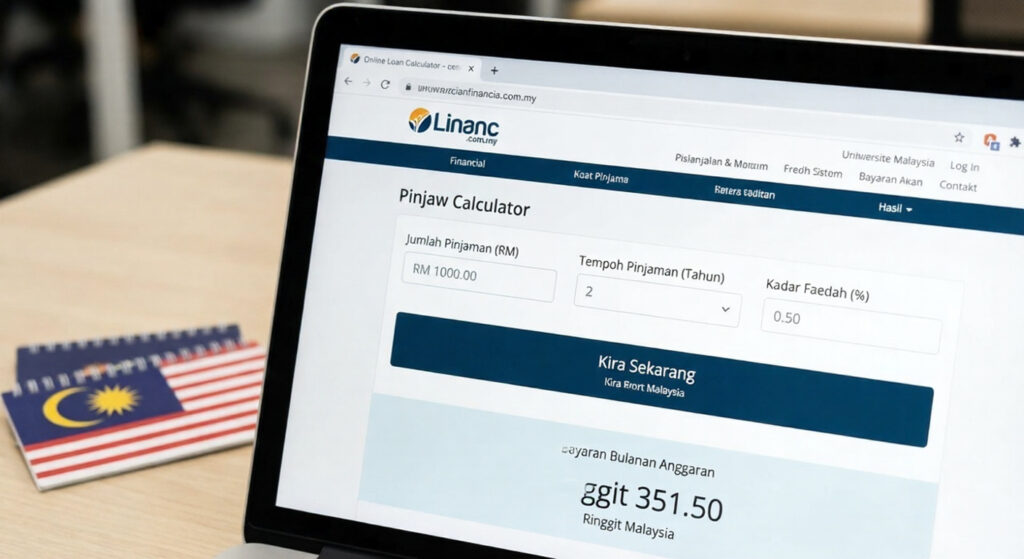

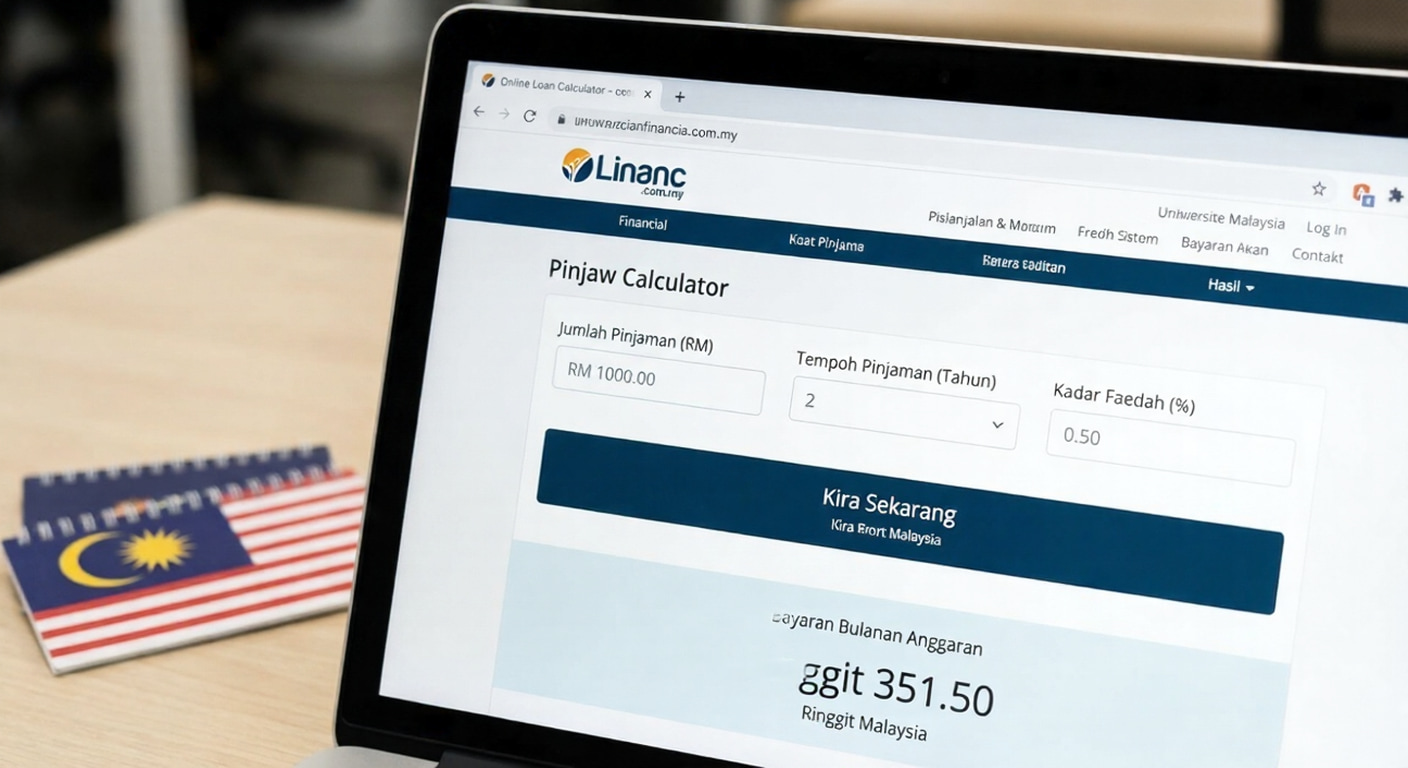

Planning to buy a house in Malaysia? The most important step is checking your monthly budget first. Our guide shows you how to use a calculator loan rumah to see exactly what you can afford right now.

But we know life isn’t just about housing. If you are also shopping for a new ride, our calculator loan kereta section will help you check your car payments accurately. We even cover specific tools like a toyota loan calculator so you can plan for that new Vios or Camry without stress. Stop guessing and start planning! Read on to master your loans and get approved quickly.

Key Takeaways

- Check Affordability First: Before applying, use a calculator loan rumah to ensure your monthly repayment does not exceed your budget. Banks typically require a Debt Service Ratio (DSR) of below 60% for approval.

- Prepare for Hidden Costs: For housing loans, remember that the “sticker price” isn’t the final cost. You must have cash ready for the 10% down payment, legal fees, and valuation costs, though first-time buyers may qualify for Stamp Duty exemptions until 2027.

- Understand Car Loan Interest: When using a calculator loan kereta, keep in mind that car loans usually use Fixed Rates. This means the interest is calculated on the full principal upfront, so paying early saves you less money compared to home loans.

- Watch the “Rule of 78”: New regulations in 2026 are discouraging the “Rule of 78” calculation method for personal loans, leading to fairer settlement terms, but you should always check the Effective Interest Rate (EIR) rather than just the flat rate.

- Specific Brand Tools: If you are targeting a specific vehicle brand, using a niche tool like a toyota loan calculator can help you estimate monthly costs for specific models like the Vios or Yaris more accurately than a generic calculator.

How Do I Calculate My Monthly Loan Repayment?

To plan your budget effectively, you should use online tools to check your monthly payments before applying for credit. If you are buying a house, a calculator loan rumah helps you find your estimated payment based on the property price and a 35-year term. For a new car, you can use a calculator loan kereta to see if the monthly cost fits your salary over 9 years. If you want a specific brand, a toyota loan calculator is very useful because it uses real prices for models like the Vios or Camry. Always compare these results with your income to make sure the bank will approve your loan.

How to Use This Loan Calculator

Have you ever looked at a bank application and felt confused by all the boxes and numbers? You are not alone! Before we jump into the specific calculators for houses or cars, let’s learn the basics.

To get the right answer from any calculator, you need to feed it the right information. Think of it like a recipe—if you put in the wrong ingredients, the cake won’t taste good. Here are the three main “ingredients” you need for any loan:

1. Principal (The Loan Amount)

This is the total amount of money you want to borrow.

- For a house: It is the price of the house minus your down payment.

- For a car: It is the price of the car minus your deposit.

2. Tenure (The Timeline)

This is just a fancy word for “how long you will take to pay it back.”

- Housing: Usually up to 35 years (or until you turn 70 years old).

- Personal: usually 2 to 10 years.

- Car: Usually 5, 7, or 9 years.

3. Interest Rate (The Cost)

This is the profit the bank makes for lending you money. In Malaysia, we also have Islamic Financing, which uses a “Profit Rate” instead of an interest rate. For you as a borrower, the result is very similar: it is the extra money you pay on top of what you borrowed.

Note for 2026: Most housing loans are now linked to the Standardised Base Rate (SBR). As of early 2026, the SBR is around 2.75%. When you see a bank offer “SBR + 1.25%,” it means your total interest rate is roughly 4.00%.

Personal Loan Calculator: Planning for Cash Liquidity

Sometimes you need cash quickly. Maybe it is for a wedding, a medical emergency, or to renovate your kitchen. A personal loan is useful, but it can be tricky.

Flat Rate vs. Reducing Balance Rate

This is the most important secret about personal loans. Banks often advertise a “Flat Rate” which looks very low, like 3.99%. But be careful!

A 3.99% Flat Rate is roughly equal to an Effective Rate of 7% to 8% on a housing loan. Why? Because with a Flat Rate, you are charged interest on the original loan amount for the whole 5 or 7 years, even after you have paid back half of it!

Tenure Impact on Total Interest Paid

Let’s compare two options for a RM20,000 loan at a 5% flat rate.

| Tenure | Monthly Payment | Total Interest You Pay |

| 2 Years | RM916 | RM2,000 |

| 5 Years | RM416 | RM5,000 |

What do we learn here?

Taking a 5-year loan makes your monthly payment much smaller (RM416 vs RM916). But look at the total interest! You end up paying the bank RM3,000 more just for the extra time.

Always try to pick the shortest tenure you can afford.

The “Rule of 78” Update

Have you heard of the “Rule of 78”? It is an old method banks used to calculate interest. Basically, it made the borrower pay almost all the profit to the bank in the first few years.

Update for 2026: Bank Negara Malaysia has introduced stricter rules. Most new loans now use fairer calculation methods. However, if you want to settle your loan early (for example, paying it off in 2 years instead of 5), always check your contract for an “Early Settlement Penalty.”

Scenario: The Renovation Loan

Let’s say John wants to renovate his kitchen. He needs RM30,000.

- Bank A offers a Personal Loan: 5% Flat Rate for 5 years.

- Bank B offers a “Renovation Loan” linked to his Home Loan: 4.5% Reducing Balance Rate for 10 years.

Calculation for Bank A (Personal Loan):

- Total Interest = RM30,000 x 5% x 5 years = RM7,500.

- Monthly Pay = (RM30,000 + RM7,500) / 60 months = RM625.

Calculation for Bank B (Top-up Home Loan):

- Because the tenure is longer (10 years), the monthly payment might be lower (around RM310).

- However, because he pays interest for 10 years, the total cost might be higher in the long run unless he pays extra every month.

Lesson: Always check if your bank allows you to “Top Up” your housing loan. It is often cheaper than a standard personal loan.

Car Loan (Hire Purchase) Calculator

Buying a car is a very emotional experience. We smell that “new car smell” and get excited. But cars depreciate (lose value) very fast. You don’t want to be stuck paying a high loan for a car that is losing value every day.

Using a calculator loan kereta is essential before you step into a dealership.

The 10% Down Payment Rule

In Malaysia, the maximum loan margin for a car is usually 90%. This means you must pay 10% in cash.

- Car Price: RM80,000

- Down Payment: RM8,000

- Loan Amount: RM72,000

If a dealer tells you “Full Loan Available,” be very careful. This often involves marking up the car price artificially, which is illegal and risky. It puts you “underwater” on your loan instantly. Being “underwater” means you owe more money to the bank than the car is worth. If you try to sell the car two years later, you will have to pay cash to the bank just to sell it!

Variable vs. Fixed Rates

Unlike houses, most car loans use Fixed Rates.

- Pros: Your monthly payment never changes, even if the economy gets bad.

- Cons: Because the interest is fixed upfront, paying off your car loan early usually does not save you much money.

Specific Brand Tools: The Toyota Loan Calculator

Are you eyeing a specific model? Let’s say you want a Toyota Vios. Instead of a general calculator, you might want to search for a toyota loan calculator.

Why? Because these brand-specific calculators often include the latest promotions.

- Sometimes Toyota offers a special interest rate (e.g., 2.5%) for the Vios.

- A general calculator might default to the standard bank rate (e.g., 3.0%).

- Using the specific tool gives you a more accurate number for your budget.

Toyota Capital Malaysia often has different plans, such as “EZ Beli.” This is a tiered repayment scheme.

- Years 1-3: You pay a very low monthly amount.

- Years 4-6: The payment goes up moderately.

- Years 7-9: The payment is higher.

A standard bank calculator will show you a flat monthly fee. A toyota loan calculator will show you these “stepped” payments. This helps you plan. If you expect your salary to go up in 3 years, the EZ Beli plan might be good. If your salary is stable, a standard bank loan is safer.

The 9-Year Trap

In Malaysia, you can take a car loan for up to 9 years. Many people do this to get a lower monthly payment.

- Car: Honda City (RM90,000 loan).

- 5 Years (3%): Monthly = RM1,725. Total Interest = RM13,500.

- 9 Years (3%): Monthly = RM1,058. Total Interest = RM24,300.

By choosing 9 years, you pay RM10,800 extra in interest! Also, after 9 years, your car will be quite old and might need expensive repairs. Try to stick to a 5-year or 7-year loan if you can.

Will My Loan Be Approved? (The DSR Logic)

You have done the math. You know the monthly payment. But will the bank actually say “Yes”?

To decide, banks use a secret formula called the Debt Service Ratio (DSR).

What is DSR?

DSR basically asks: “How much of your salary is already eaten up by debt?”

The Formula is:

Total Monthly Commitments ÷ Net Income × 100 = DSR %

Let’s Meet Ali

- Ali’s Net Income: RM4,000 (after tax and EPF)

- Current Car Loan: RM600

- PTPTN Loan: RM200

- Credit Card Minimum: RM200

- Total Commitments: RM1,000

Ali wants to apply for a new house loan that costs RM1,500 per month.

- New Total Commitment: RM1,000 (old debt) + RM1,500 (new house) = RM2,500.

- Ali’s DSR: RM2,500 ÷ RM4,000 = 62.5%.

Will Ali get approved?

Maybe. Most banks prefer a DSR below 60%. Since Ali is at 62.5%, he is in the “Grey Zone.” He might need to show extra savings or clear his credit card debt to get approved.

Does PTPTN Matter?

Yes! Many young Malaysians think banks don’t check PTPTN student loans. This is false. PTPTN is listed in your CCRIS report (the report card banks use to check your credit). If you have missed PTPTN payments, your housing loan will likely be rejected.

The Danger of “Buy Now Pay Later” (BNPL)

In 2026, credit reports are getting smarter. Many “Buy Now Pay Later” schemes (like for buying phones or clothes in installments) are now visible to banks. If you have too many small BNPL debts, it can hurt your DSR. Clear them before applying for a big loan!

Documents You Need for Loan Application

Using the calculator is step one. Step two is getting your paperwork ready. If your documents are messy, the bank officer might reject you even if your DSR is good.

Here is a checklist for 2026:

For Salaried Employees:

- IC Copy: Front and back, clear copy.

- Payslips: Last 3 months (6 months if you earn commission).

- Bank Statements: Last 3 months (showing salary coming in).

- EPF Statement: Detailed statement for the last 12 months.

- EA Form: Your yearly tax form from your employer.

For Business Owners / Freelancers:

- SSM Certificate: Showing your business registration.

- Company Bank Statements: Last 6 months.

- Form B / BE: Your income tax receipt for the last 2 years.

- Financial Accounts: Profit & Loss statement (if applicable).

Tip: If you have a lot of “variable income” (like overtime or commission), the bank might not count 100% of it. They usually take only 80% or 50% of that income when calculating your DSR. This means your “Net Income” in the bank’s eyes might be lower than what you see in your bank account.

How to Improve Your Credit Score Before Applying

If you used the calculator and realized your DSR is too high, or you are worried about approval, here are specific steps to fix your profile.

1. Clean Up CCRIS

Your CCRIS report shows your payment history for the last 12 months. If you have any “1” or “2” marks (meaning you paid 1 or 2 months late), pay them off immediately. You need to wait 12 months for those marks to disappear completely, but showing a string of “0” (on-time payments) for the last 3-4 months helps a lot.

2. Reduce Credit Card Usage

If your credit card limit is RM10,000 and you have used RM8,000, your utilization is 80%. This looks risky to banks. Try to pay it down so you are using less than 50% of your limit.

3. Combine Debts

If you have 3 different credit cards and a personal loan, it looks messy. If possible, consolidate them into one cheaper loan. This lowers your monthly commitment, which lowers your DSR.

4. Build a Credit History

This sounds strange, but if you have zero loans and zero credit cards, banks might reject you. They have no “history” to judge you by. Applying for one credit card and paying it in full every month is a good way to build a “trust score” with the bank.

Frequently Asked Questions (FAQ)

Here are the Frequently Asked Questions (FAQ) designed for Grade 8 readability, focused on what users are actually searching for in 2026.

1. How do I use a calculator loan rumah properly?

To get an accurate result from a calculator loan rumah, you need three things: the house price, your down payment, and the loan period. Most people in Malaysia choose a loan period of 35 years to keep the monthly payment low. Remember to check the current interest rate (around 4.0% to 4.5% in 2026) to see if you can truly afford the monthly cost.

2. How is a calculator loan kereta different from a house loan?

A calculator loan kereta usually uses a Fixed Interest Rate. This means the total interest is calculated upfront on the full loan amount. Unlike a house loan, the interest does not get smaller as you pay off the debt. Also, the maximum time to pay back a car loan is only 9 years, not 35 years.

3. Why should I use a specific toyota loan calculator?

General calculators often use “average” numbers. A brand-specific tool, like a toyota loan calculator, is better because it knows the exact price of models like the Vios, Yaris, or Camry. It also includes current promotions or special low-interest rates (like 2.5%) that a standard bank calculator might miss.

4. How much salary do I need to get my loan approved?

Banks use a formula called the Debt Service Ratio (DSR). A good rule is that your total debt payments (house + car + credit cards) should not be more than 60% of your net salary. If you earn RM4,000 a month, your total debt payments should stay under RM2,400 to get approved easily.

5. Do I have to pay Stamp Duty for a house in 2026?

If you are a first-time home buyer and the house costs RM500,000 or less, you do not have to pay Stamp Duty! The government has extended the 100% Stamp Duty exemption until December 31, 2027. This can save you thousands of Ringgit upfront.

6. Does my PTPTN loan affect my application?

Yes, it does. PTPTN loans appear on your credit report (CCRIS). If you do not pay your PTPTN on time, the bank may reject your housing or car loan application. You should clear any missed payments before you apply.

7. What happens if I miss a payment?

If you miss a payment, the bank will charge you a “Late Payment Fee” (usually 1% of the amount owed). More importantly, it puts a “1” on your CCRIS report. If you miss 3 months in a row, the bank can classify your loan as “Non-Performing” and start the legal process to take back your house or car. Always call your bank before you miss a payment if you have financial trouble. They can often restructure your loan to help you.

Ready to Take the Next Step?

Buying a new home or driving your dream car is a huge milestone. It is exciting, but you must be smart about your money. Don’t let the excitement make you sign a contract you cannot afford.

Take a few minutes right now to use our tools. Use the calculator loan rumah to plan your future home budget, or check the calculator loan kereta to see if that new ride fits your salary. If you have your eyes on a specific model, the toyota loan calculator can give you the most accurate numbers.

Remember, a loan is not just about getting cash today; it is about your financial freedom tomorrow. Calculate first, check your eligibility, and apply with confidence.